Here’s all the good stuff

Reliable system

From direct integrations with card networks and banks to checkout flows in the browser, we operate on and optimize at every level of the financial stack.

50+ integrations

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et.

Intelligent optimizations

Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Intuitive design

Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

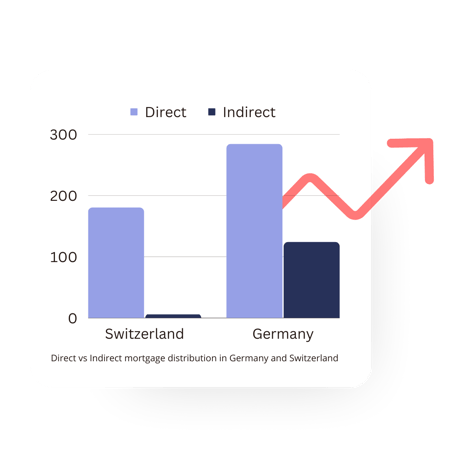

The broker market is on the rise

The mortgage broker sector in Switzerland has experienced a remarkable surge in the decade. This growth has been fuelled by the dominance of big broker platforms, which constitute 60% of the market share, and smaller regional structures, which make up the remaining 40%. Our analysis predicts that both segments will continue to expand in the next five years.

However, the current business process for handling broker businesses is unstructured and time-consuming, leading to low conversion rates of only 30% and high acquisition costs for lenders. Today this affects lenders through low conversion rates of up to 30% and high acquisition costs. If the broker market share increases, as our analysis shows, lenders must further structure and standardize their processes and digital technologies. Simple steps can lead to great business outcomes.

The Swiss broker market is on the rise

The mortgage broker sector in Switzerland has experienced a remarkable surge in the decade which has been fuelled by the dominance of big broker platforms and smaller regional structures. Our analysis predicts that both segments will continue to expand in the next five years.

However, the current business process for handling broker businesses is unstructured and time-consuming, leading to low conversion rates and high acquisition costs for lenders. If the broker market share increases, lenders must further structure and standardize their processes and digital technologies in order to remain efficient and competitive.

This report explores how lenders can make the most out of the opportunities of partnering with brokers.

"The Swiss market holds immense potential for further intermediation"

Customize metrics to create your story

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ultricies leo integer malesuada nunc vel risus commodo viverra. At erat pellentesque adipiscing commodo elit at.

"The Swiss market holds immense potential for further intermediation"

What's inside?

Download the report and learn more about:

- The current state of the Swiss mortgage broker market and its growth potential.

- The challenges that lenders face when working with brokers.

- How small and large brokers can benefit from different digital solutions.

- Real-world examples of how lenders have successfully implemented digital solutions and achieved significant efficiency gains.

- The potential for the broker channel to become a more cost-efficient acquisition channel for lenders.

Get our free ebook on how you can level up your B2B SaaS content marketing

Get our free ebook on how you can level up your B2B SaaS content marketing

Need clarification?

What is T2D3?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Can I use T2D3 on my phone?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Can I change my plan later?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

What is so great about the Pro plan?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

The future of mortgages starts here

Book a tailored demo with our expert today and explore how Oper can help you streamline your mortgage processes

.png)